China has approved ambitious military modernisation programmes to increase its capabilities, including the J-20 programme, spurred by territorial claims in the South China Sea and the increasing strength and assertiveness of the US.

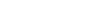

GlobalData’s latest report, “China Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-27,” reveals that China’s defence expenditure for 2022 would amount to $225.6bn, a 7.3% increase on 2021, and reflects a compound annual growth rate (CAGR) of 7.8% during 2018-2022.

Against this backdrop, China is expected to increase the defence budget at a CAGR of 7.2%, from $241.2bn in 2023 to $318.6bn in 2027, forecasts GlobalData.

“China is in the process of acquiring fighter and multirole aircraft, corvettes, submarines, naval vessels, and advanced intelligence and surveillance equipment to strengthen the armed forces by 2027,” says Rouble Sharma, aerospace and defensce analyst at GlobalData.

The modernisation plans include the procurement of the J-20 Chengdu (Mighty Dragon) fifth-generation aircraft to provide critical air support. Work is still ongoing for the Shenyang J-31 programme, another indigenous fifth-generation fighter that follows upon the J-20.

“China is in the process of acquiring advanced military technologies and platforms. The J-20 Mighty Dragon jet is the most significant production of Chinese military technology, which has grown at a robust pace over the last decade,” says Sharma.

J-20 programme development

While initial reports expected the J-20 to arrive in 2019, the Chengdu Aircraft Industry Group (CAIG) programme moved ahead of time, with the People’s Liberation Army (PLA) engaging the J-20 on its maiden flight in March of 2017. The advancement on the date of delivery can be attributed to the transfer of technology from Russian fighters. The indigenous development of J-10 and other earlier aircraft also helped to establish strong in-country research and design, and manufacturing capabilities.

“Other systems aboard the J-20, such as the avionics, radar, and weapons systems, were already built locally which helped fast-track the production rate,” said Sharma. “Additionally, China is a powerhouse of manufacturing electronic components helping it reach the mass manufacturing phase quickly, aided also by using the domestically made WS-10 engines.”

The J-20 programme has seen a number of different engine configurations as new technologies have been tested and implemented. China initially constructed the J-20 to include Russia’s 117 engines but found this design to have limitations in performance and tethering issues and was not as compatible with low observable technology. For newer planes CAIG shifted to the indigenously developed WS-10, to maximise its flexibility. “Tethering and performance issues might have been fixed over the development phase,” adds Sharma.

The J-20 is able to carry six missiles, including four medium- or long-range air-to-air missiles in its main bay and one smaller short-range missile in each of its two lateral bays. The wings also hold four hardpoints that have been used to carry external fuel canisters during peacetime operations. The load-out is fitting for engagement from long standoff ranges, suiting the J-20s its stealth capabilities, and without an internal canon it is unlikely to be used in short-range dogfighting.

“It is designed to execute ground attack missions even in hostile environments. The aircraft can reach higher altitudes with its delta wings at supersonic speed to achieve strategic independence,” Sharma continues. “The fifth-generation fighter can complement the air superiority variant currently in service and will be used to monitor the Taiwan Strait and the East China Sea.”

WS-15 engine completes testing

The PLA aims to reduce the technology gap with the US and other technologically advanced countries. Principal areas that still need attention include the application of artificial intelligence, mastering long-range standoff precision strike capabilities, improved stealth, and the use of unmanned weaponry, according to Sharma.

As recently as March 2022, Chinese state broadcaster CCTV reported that the new WS-15 engine had completed testing and would be ready to move into a new phase replace J-20s in service that still had Russian engines. The new WS-15 is expected to have much greater fuel efficiency and power, providing the J-20 with a greater endurance and flight performance.

While it is difficult to assess the overall cost of the programme, with the assumption that it is at par with other fifth-generation aircrafts in terms of scale and technology, the current cost of the Chengdu is estimated to be around $100m per aircraft, and the overall programme is anticipated to cost around $30bn, according to the Global Data Fixed-Wing Market Forecast of 2022-32.

The same engines have been used across multiple indigenous aircraft, making maintenance and operational expenses get easier to manage, and economies of scale have helped to reduce manufacturing costs.