ReOrbit has signed a memorandum of understanding with AAC Clyde Space, a company that specialises in small satellite technologies and services, to further strengthen collaboration in streamlining data flow in space.

According to a 15 March ReOrbit release, the objective of the partnership is to develop a joint small satellite core avionics and flight software product, where AAC Clyde Space provides the designated hardware and ReOrbit provides the designated software.

ReOrbit has a number of customers in the defence, security, satellite communications, and Earth observation fields, and was recently accepted as a member of the Association of Finnish Defence and Aerospace Industries.

The development of a stand-alone box of flight software and avionics for small satellites is intended to simplify supply chains and satellite integration. The system can be used for a variety of payloads, such as Earth observation, satellite communications, or orbital transfer vehicles, and intended to be integrated with other onboard systems regardless of supplier.

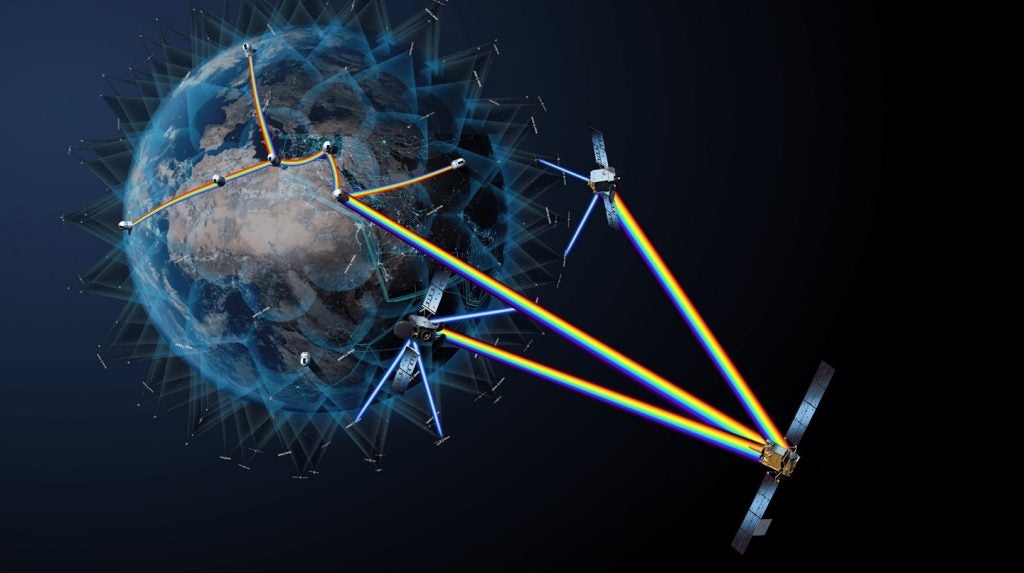

Data flow is one of the main limiting factors in the space domain, with capacity a finite resource that has to accommodate multiple requirements and demands for use by terrestrial entities.

See Also:

Defence use of space technology

In recent years, the growth of the global space sector and increased competitiveness has seen militaries increasingly utilise private sector and commercial space-based capabilities for uses in areas such as Earth observation, and intelligence, surveillance, and reconnaissance (ISR) operations.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to GlobalData’s 2021-2031 military satellite sector analysis, the global market was valued at $9.4bn in 2021 and is projected to reach $13.7bn by 2031, registering a compound annual growth rate of 3.76%. The market was cumulatively valued at $104.5bn over the reporting period, totalling business potential across communications, ISR, navigation, and meteorology.

Of this, the ISR segment was forecast to be the strongest, accounting for 51% of the market, followed by communications with a 30.9% share.

Among geographic segments, North America was projected to dominate the sector with a share of 42.9%, followed by Europe and Asia-Pacific with shares of 30.3% and 18.8% respectively.

In this market, defence primes often compete with companies operating in the commercial sector, with the latter able to provide a range of technologies and operating practices that benefit the traditionally slow-paced development of military space technologies.