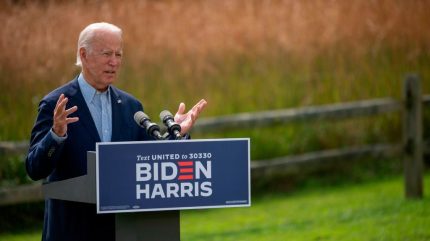

Joe Biden’s victory in the US presidential election has brought with it hopes that the White House will now embrace environmental, social, and governance (ESG) issues, after four years of Donald Trump reversing many of the ESG-related policies brought in by his predecessors.

Indeed, Nigel Green, CEO and founder of financial advisory organisation deVere Group, believes that “Biden’s administration will usher in an unprecedented boom for ESG investments for two key reasons”, according to a press release from the company.

The first reason is based upon the fact that Biden and Vice-President-elect Kamala Harris have “actively championed on the election trail and before values that have an inherent synergy with ESG-oriented investments”, according to Green. He explains that they have campaigned on issues including climate change, social justice, equality, diversity, human rights, and corporate transparency and accountability.

For the second reason, Green explains that “it is probable that US rules surrounding ESG investing and corporate disclosures will now come into line with those of Europe – something Trump fiercely opposed. If the rules on ESG investing are matched and agreed upon, and an international standard and framework brought in, we can expect further institutional investment piling into the ESG sector”.

Indeed, it would be a landmark moment if an international standard and framework were to be brought in with regards to ESG, especially as the investment community has identified the US election as the most significant recent event in terms of sustainable investing. A Morgan Stanley survey shows that 51% of investors think the “US election will be more impactful for sustainable investing than the EU Green Deal or China’s net zero target” over the next 12 months.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFocusing on the environmental part of ESG

Biden has made a long list of pledges when it comes to the environment, including a $2trn climate change plan, achieving net-zero carbon emissions in the US by 2050, establishing the first National Climate Council, and rejoining the Paris Climate Agreement, among others.

The US officially withdrew from the Paris Climate Agreement the day after the US election. However, the country started the formal exit from the agreement in late 2019 under the Trump presidency. This came after Trump had rolled back more than 100 environmental regulations.

Nevertheless, if Biden moves forward with his pledges then the Climate Action Tracker believes it will have a positive impact on the Paris Agreement’s target of keeping climate change to within a rise of 1.5°C. A document published in late 2020 by the organisation stated that “if Biden goes ahead with his net-zero emissions pledge by 2050 for the US, this could shave 0.1°C off global warming by 2100. Coupled with China’s pledge to bring emissions to net zero before 2060, and the EU, Japan and South Korea’s commitments to reach net zero by 2050, a tipping point is being approached that puts the Paris Agreement’s 1.5°C limit within reach.”

On top of this pledge, Biden has vowed that his $2trn green plan will include investment in the energy and transportation sectors, as well as speed up the transition from fossil fuels to renewables, creating new jobs in the process.

A healthier, wealthier US?

Healthcare is another area that was a key policy focus for Biden in his campaign.

“With the US committed to a Green Deal, and mental health and physical health inextricably linked, the right investment can be made in green infrastructure and community health activities that see both the environment and people’s well-being improved,” says Gareth Presch, CEO at World Health Innovation Summit.

Indeed, amid the outbreak of Covid-19, Biden is pledging to expand the Affordable Care Act, giving more people access to health insurance and mental health services. In fact, he vowed to oversee the “enforcement of mental health parity laws and expand funding for mental health services”. Biden has previously called for more investments in hiring mental health clinicians and peer support counsellors, as well as increased training for healthcare professionals.

Presch adds that the opportunity exists to create a US model that creates value based on prevention and early intervention that will empower people and communities to improve their health and well-being, support existing health services, create new and meaningful jobs, and support the implementation of the UN’s Sustainable Development Goals.

Rising challenges

Despite Biden’s pledges to embrace ESG investment, the Republicans holding the US Senate in the January run-off, or divisions within the Democrats, could wreck the president-elect’s ESG plans. According to the BlackRock Investment Institute: “A Democratic sweep – with the party also seizing control of the US Senate – looks unlikely, although the run-off election for two Georgia Senate seats in January keeps the race alive. A divided government would constrain the Biden administration’s ability to implement plans for large-scale fiscal stimulus and public investment, as well as tax, healthcare and climate-related legislation.”

Nevertheless, the document also mentions that the organisation sees “an increased focus on sustainability under a divided government, but through regulatory actions, rather than via tax policy or spending on green infrastructure. It also would likely signify a return to more predictable trade and foreign policy – even as any US-China rivalry looks set to stay elevated due to bipartisan support for a more competitive stance.”

As a result, it would seem that there are different paths open to Biden to pursue his ESG agenda, even under a divided government. The president-elect, whose inauguration will take place on 20 January, has talked a good ESG game. However, with these themes only set to increase in importance over the next decade, all eyes will be on the actions Biden takes once firmly ensconced in the White House.

Visit our sister site Energy Monitor for more features on clean energy, such as this article looking at how clean energy investors were betting on a Biden win in the run-up to November’s election.