The aerospace and defense industry continues to be a hotbed of patent innovation. Activity is driven by the need to lower operational costs, larger consumer trends, and electrification, and growing importance of technologies such as hydrogen and electric aircraft and advanced materials. In the last three years alone, there have been over 237,000 patents filed and granted in the aerospace and defense industry, according to GlobalData’s report on Innovation in defense: aircraft fuel cell APUs. Buy the report here.

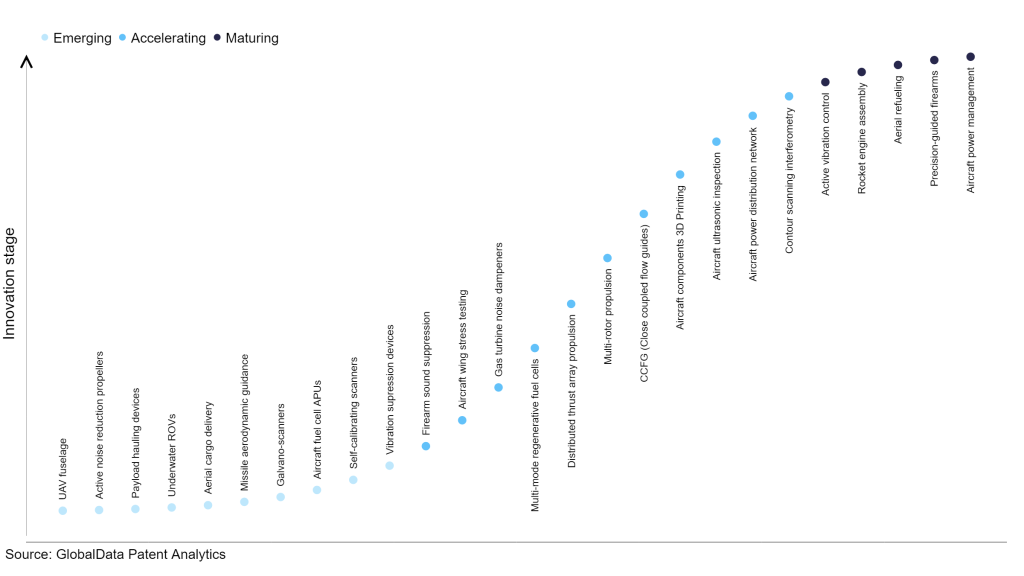

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

110 innovations will shape the aerospace and defense industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defense industry using innovation intensity models built on over 206,000 patents, there are 110 innovation areas that will shape the future of the industry.

Within the emerging innovation stage, aircraft fuel cell APUs, self-calibrating scanners, and vibration suppression devices are disruptive technologies that are in the early stages of application and should be tracked closely. Aircraft ultrasonic inspection, aircraft power distribution network, and contour scanning interferometry are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are precision-guided firearms and aircraft power management, which are now well established in the industry.

Innovation S-curve for the aerospace and defense industry

Aircraft fuel cell APUs is a key innovation area in aerospace and defense

Auxiliary Power Units (APUs) are systems which allow support systems on aircraft, such as air conditioning, communications, and other electronic systems to function. They are power systems, which are separate from the means of propulsion.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 60+ companies, spanning technology vendors, established aerospace and defense companies, and up-and-coming start-ups engaged in the development and application of aircraft fuel cell APUs.

Key players in aircraft fuel cell APUs – a disruptive innovation in the aerospace and defense industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to aircraft fuel cell APUs

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Liebherr-International | 31 | Unlock Company Profile |

| Rolls-Royce | 19 | Unlock Company Profile |

| AeroVironment | 11 | Unlock Company Profile |

| Diehl Stiftung | 52 | Unlock Company Profile |

| Melrose Industries | 23 | Unlock Company Profile |

| Toyota Motor | 27 | Unlock Company Profile |

| TCOM | 2 | Unlock Company Profile |

| NACCO Materials Handling Group | 8 | Unlock Company Profile |

| Schaeffler | 2 | Unlock Company Profile |

| Siemens | 12 | Unlock Company Profile |

| E.ON | 4 | Unlock Company Profile |

| Hyundai Motor | 10 | Unlock Company Profile |

| Parker Hannifin | 3 | Unlock Company Profile |

| Snecma | 17 | Unlock Company Profile |

| General Electric | 67 | Unlock Company Profile |

| BAE Systems | 27 | Unlock Company Profile |

| Porsche Automobil | 5 | Unlock Company Profile |

| Raytheon Technologies | 45 | Unlock Company Profile |

| Groupe Industriel Marcel Dassault | 11 | Unlock Company Profile |

| Doosan | 31 | Unlock Company Profile |

| Aviva | 6 | Unlock Company Profile |

| Textron | 17 | Unlock Company Profile |

| Safran | 166 | Unlock Company Profile |

| Boeing | 45 | Unlock Company Profile |

| Airbus | 475 | Unlock Company Profile |

| Honeywell International | 6 | Unlock Company Profile |

| Deutsches Zentrum fur Luft- und Raumfahrt | 8 | Unlock Company Profile |

| Kia | 5 | Unlock Company Profile |

| Infinity Fuel Cell and Hydrogen | 4 | Unlock Company Profile |

| Airbus Defence and Space | 3 | Unlock Company Profile |

| Zodiac Seats France | 9 | Unlock Company Profile |

| Intertechnique | 4 | Unlock Company Profile |

| EADS Deutschland | 15 | Unlock Company Profile |

| Meditor European Master Fund | 27 | Unlock Company Profile |

| ArianeGroup | 12 | Unlock Company Profile |

| Alakai Technologies | 37 | Unlock Company Profile |

| H3 Dynamics | 10 | Unlock Company Profile |

| Aurora Innovation | 8 | Unlock Company Profile |

| Linde | 8 | Unlock Company Profile |

| BayoTech | 6 | Unlock Company Profile |

| S-Fuelcell | 2 | Unlock Company Profile |

| Volans-I | 2 | Unlock Company Profile |

| ZeroAvia | 19 | Unlock Company Profile |

| Foshan Shenfeng Aviation Technology | 1 | Unlock Company Profile |

| Spawnt | 6 | Unlock Company Profile |

| Bio Cellular Design Aeronautics Africa | 2 | Unlock Company Profile |

| Nanotek Instruments Group | 2 | Unlock Company Profile |

| Huaneng Group Technology Innovation Center | 1 | Unlock Company Profile |

| Universal Hydrogen | 19 | Unlock Company Profile |

| UAV Factory | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Among aerospace and defense companies, Airbus is the leading patent filer in aircraft fuel cells APUs. The company is heavily invested in zero-emissions aircraft development through its ZEROe program, which is targeting a 2035 rollout for commercial aircraft that utilize hydrogen propulsion. Fuel cells are an essential component of hydrogen propulsion, and fuel cell APUs are integral to fuel cells for aircraft propulsion. Other key patent filers include Safran and General Electric.

In terms of application diversity, BayoTech leads the pack. Bio Cellular Design Aeronautics and Foshan Shenfeng Aviation stand in second and third spots, respectively. By geographic reach, Linde holds the top position, followed by NACCO Materials Handling and Universal Hydrogen.

Fuel cell-based propulsion is a promising technological avenue to reduce the emissions produced by commercial aircraft, and therefore improve the sustainability performance of the industry. In light of this, fuel cell components such as fuel cells APUs are essential developments.

To further understand the key themes and technologies disrupting the aerospace and defense industry, access GlobalData’s latest thematic research report on Aerospace & Defense.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.