The aerospace and defence industry continues to be a hotbed of innovation, with activity driven by the pressing need for modernisation and the growing importance of emerging technologies such as artificial intelligence and unmanned systems. In the last three years alone, there have been over 174,000 patents filed and granted in the aerospace and defence industry, according to GlobalData’s report on Internet of Things in Aerospace, Defence & Security: Drone battery swapping. Buy the report here.

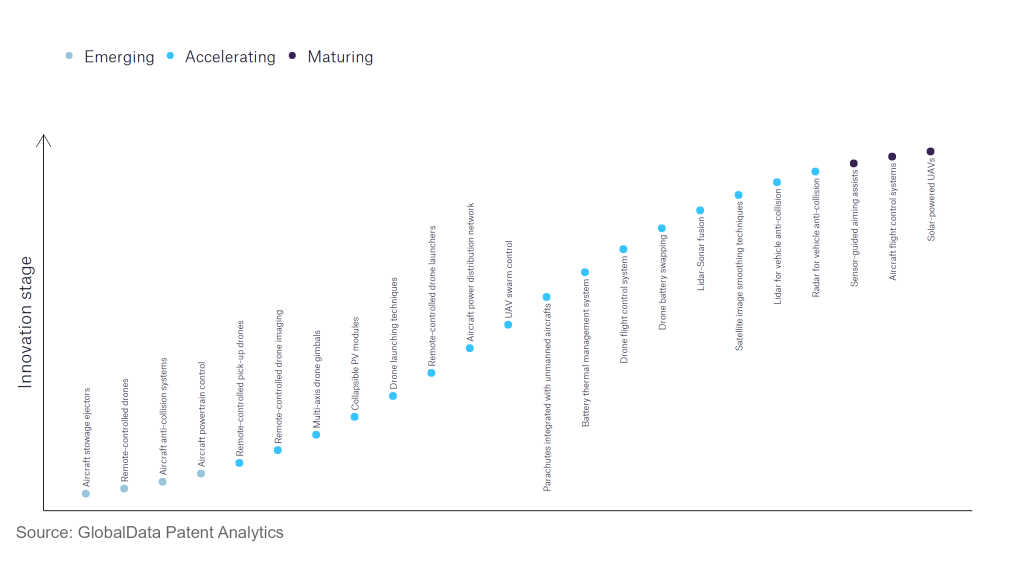

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

180+ innovations will shape the aerospace and defence industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defence industry using innovation intensity models built on over 262,000 patents, there are 180+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, aircraft powertrain controls, remote controlled drones, and aircraft anti-collision systems are disruptive technologies that are in the early stages of application and should be tracked closely. UAV swarm control, LiDAR for vehicle anti-collision, and satellite image smoothing techniques are some of the accelerating innovation areas, where adoption has been steadily increasing.

Innovation S-curve for Internet of Things in the aerospace and defence industry

Drone battery swapping is a key innovation area in Internet of Things

Drone battery swapping refers to systems enabling modular batteries to be removed and installed on drone platforms, allowing for rapid recharging turnaround.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10+ companies, spanning technology vendors, established aerospace and defence companies, and up-and-coming start-ups engaged in the development and application of drone battery swapping.

Key players in drone battery swapping – a disruptive innovation in the aerospace and defence industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to drone battery swapping

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| SZ DJI Technology | 100 | Unlock Company Profile |

| Boeing | 20 | Unlock Company Profile |

| Workhorse Group | 14 | Unlock Company Profile |

| Walmart | 13 | Unlock Company Profile |

| MinebeaMitsumi | 13 | Unlock Company Profile |

| Nileworks | 12 | Unlock Company Profile |

| Sony Group | 11 | Unlock Company Profile |

| International Business Machines | 8 | Unlock Company Profile |

| Ai Robotics | 7 | Unlock Company Profile |

| Ford Motor | 6 | Unlock Company Profile |

| Wistron | 6 | Unlock Company Profile |

| NEC | 6 | Unlock Company Profile |

| Amazon.com | 6 | Unlock Company Profile |

| Asylon | 6 | Unlock Company Profile |

| SpearUAV | 5 | Unlock Company Profile |

| Identified Technologies | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

SZ DJI Technology is one of the leading patent filers in drone battery swapping. The firm is a leading producer of commercial and civil drones, and is offering products for use in the agriculture, industrial, mining, oil and gas, and logistics sectors. The company’s commercial products include the DJI AGRAS T40 and MATRICE 300 RTK. In order to increase the economic viability of drones in these sectors, it is essential for associated infrastructure such as recharging solutions to be developed in tandem. Some other key patent filers include Boeing, which is developing an electric vertical take-off and landing (EVTOL) aircraft for urban air mobility (UAM) through its Wisk Aero subsidiary, and Workhorse Group, an OEM developing electric logistics solutions.

In terms of application diversity, MinebeaMitsumi leads the pack. NEC and Identified Technologies stand in the second and third positions, respectively. Regarding geographic reach, Nileworks held the top position, followed by MinebeaMitsumi and Ai Robotics.

Drone battery swapping is a technological development that has the potential to greatly enhance the viability of emerging drone sectors which rely upon intense use of small, unmanned platforms, for example in logistics. The quick replacement of modular batteries would allow for rapid turnaround of drones with depleted batteries, maximising the drone’s working time. This would have the knock-on effect of reducing the size of the fleet required to perform a given task (for example, medical deliveries in a small town), decreasing the cost of the overall operation.

To further understand how Internet of Things is disrupting the aerospace and defence industry, access GlobalData’s latest thematic research report on Thematic Research - Internet of Military Things.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.