The aerospace and defense industry continues to be a hotbed of patent innovation. Activity is driven by automation, environmental sustainability, and operational efficiency, and growing importance of technologies such as artificial intelligence (AI), Internet of Things (IoT), drones, and satellites. In the last three years alone, there have been over 237,000 patents filed and granted in the aerospace and defense industry, according to GlobalData’s report on Innovation in defense: distributed thrust array propulsion. Buy the report here.

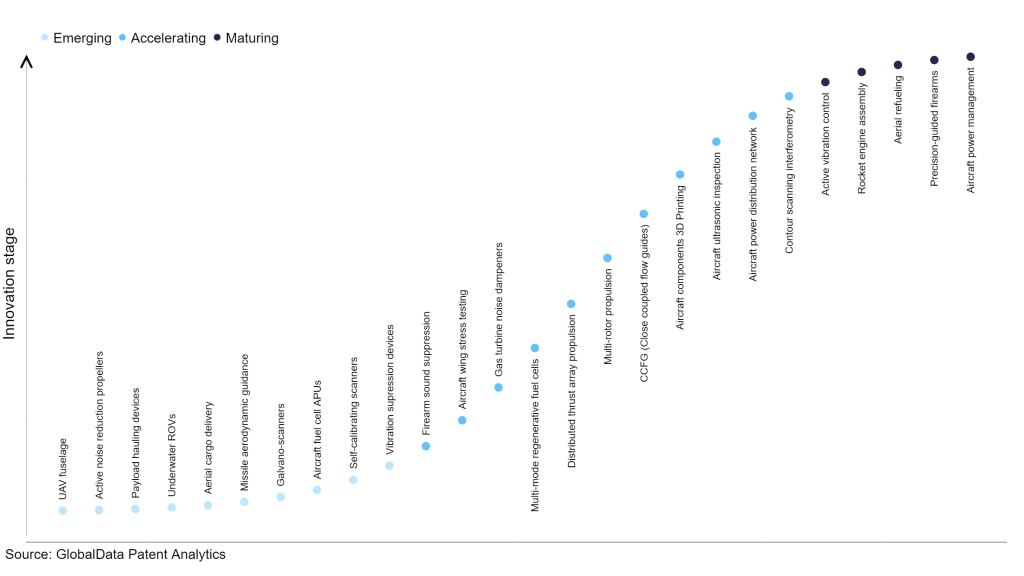

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

110 innovations will shape the aerospace and defense industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defense industry using innovation intensity models built on over 206,000 patents, there are 110 innovation areas that will shape the future of the industry.

Within the emerging innovation stage, aircraft fuel cell APUs, self-calibrating scanners, and vibration supression devices are disruptive technologies that are in the early stages of application and should be tracked closely. Aircraft ultrasonic inspection, aircraft power distribution network, and contour scanning interferometry are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are precision-guided firearms and aircraft power management, which are now well established in the industry.

Innovation S-curve for the aerospace and defense industry

Distributed thrust array propulsion is a key innovation area in aerospace and defense

Distributed thrust array propulsion involves the use of multiple propulsion units, such as rotors or propellers, that can be independently controlled by a flight control system. These units can be arranged in an array and mounted on an airframe to provide lift and propulsion for an aircraft. The use of distributed thrust allows for greater control and maneuverability of the aircraft, as well as improved efficiency and noise reduction.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 20+ companies, spanning technology vendors, established aerospace and defense companies, and up-and-coming start-ups engaged in the development and application of distributed thrust array propulsion.

Key players in distributed thrust array propulsion – a disruptive innovation in the aerospace and defense industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to distributed thrust array propulsion

Source: GlobalData Patent Analytics

Textron is one of the leading patent filers in distributed thrust array propulsion. It filed patents related to the method of providing a load from a motor to inhibit further rotation of a propeller of an aerial vehicle while in flight.

The method applies to an aerial vehicle with a special kind of vertical take-off and landing (VTOL) propeller that can operate freely. The propeller is connected to a VTOL motor. The key is to detect when the propeller is in a specific position relative to the direction the vehicle is flying. When this happens, the motor puts a load on the propeller to stop it from spinning more. This way, during regular horizontal flight, the controller can make sure the propeller is aligned to reduce air resistance and make the vehicle more efficient.

The flight test result on the company’s X-22A dual-tandem, ducted propeller, tri-service vertical short take-off and landing (V/STOL) aircraft suggested that the aircraft could benefit from advancements in engine development. This involves substituting existing engines with more advanced bypass jets or lift-fans, requiring minimal modifications to the current airframe. Additionally, the use of bypass lift engines could further mitigate issues related to reingestion.

Some other key patent filers in this space include Boeing, Volocopter, and Qualcomm.

In terms of application diversity, Boeing, Parallel Flight Technologies, and Parrot are some of the leading innovators. By means of geographic reach, some of the leading patent filers include Qualcomm, Textron, and Boeing.

To further understand the key themes and technologies disrupting the aerospace and defense industry, access GlobalData’s latest thematic research report on Aerospace & Defense.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.